Technology has had a significant impact on various industries, revolutionizing the way they operate. One sector that has been greatly influenced by technological advancements is the finance industry. With the introduction of innovative solutions, financial institutions are embracing digital transformation to streamline processes and enhance customer experience.

Automation of Processes

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

One of the key ways technology is revolutionizing the finance industry is through the automation of processes. Tasks that were once manual and time-consuming can now be completed swiftly with the help of automation technologies like robotic process automation (RPA). This has not only increased efficiency but also reduced the margin of error in financial operations.

Enhanced Security Measures

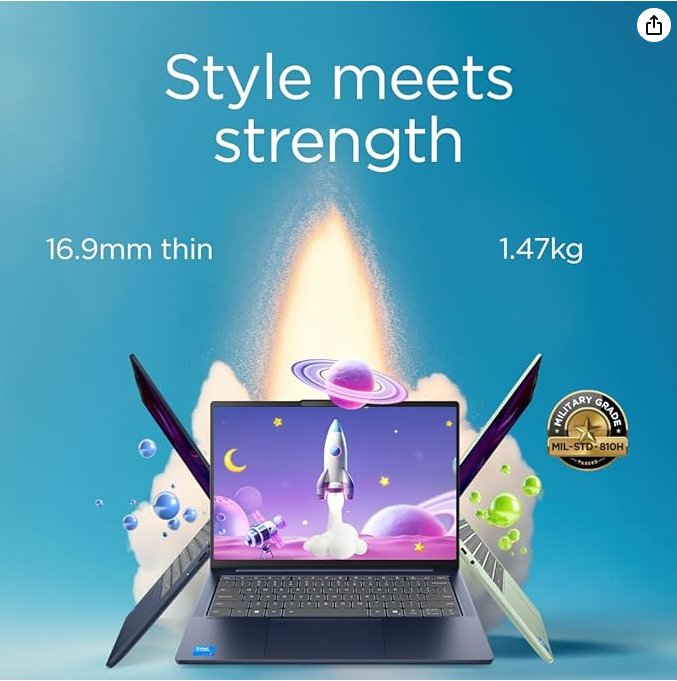

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Technology has also played a crucial role in strengthening security measures in the finance industry. With the rise of cyber threats, financial institutions are investing in advanced security solutions like biometric authentication and blockchain technology to protect sensitive data and prevent fraud.

Improved Customer Experience

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Finance technology, or “fintech,” has revolutionized the way customers interact with financial services. Through mobile banking apps, online payment platforms, and personalized financial planning tools, customers now have greater control over their finances and can access services anytime, anywhere.

Data Analytics and Insights

ZTE G5 WiFi 7 5G Router, 3600 Mbps Ultra Fast Home & Office Internet, SIM Slot Unlocked, Dual Band, Connect 128 Devices, 2.5 GbE Port, Smart Antenna – Future Ready WiFi 7

ZTE G5 WiFi 7 5G Router, 3600 Mbps Ultra Fast Home & Office Internet, SIM Slot Unlocked, Dual Band, Connect 128 Devices, 2.5 GbE Port, Smart Antenna – Future Ready WiFi 7

By leveraging big data and analytics tools, financial institutions can gain valuable insights into customer behavior, market trends, and risk management. This data-driven approach allows for more informed decision-making and tailored financial solutions for customers.

Blockchain Technology

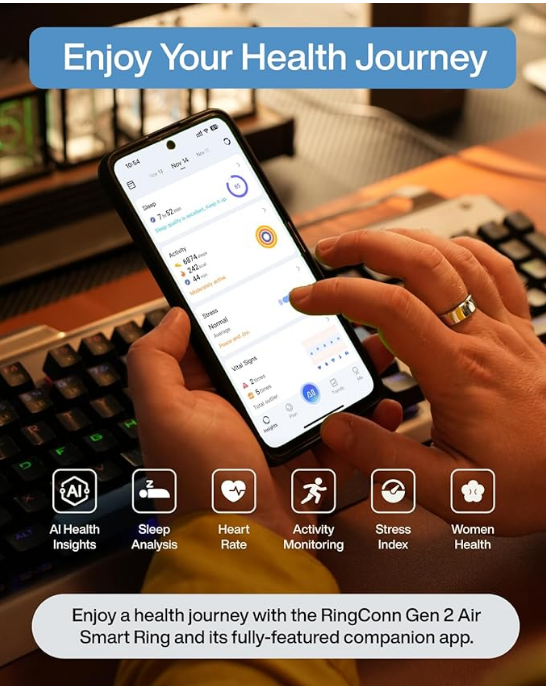

RingConn Gen 2 Air, Ultra-Thin AI Smart Ring, Size First with Sizing Kit, 10-Day Battery Life, Sleep/Heart Rate/Stress/Fitness Tracker, Compatible with Android & iOS - Size 10, Dune Gold

RingConn Gen 2 Air, Ultra-Thin AI Smart Ring, Size First with Sizing Kit, 10-Day Battery Life, Sleep/Heart Rate/Stress/Fitness Tracker, Compatible with Android & iOS - Size 10, Dune Gold

Blockchain technology has disrupted the finance industry by providing secure and transparent transactions through decentralized ledgers. This has the potential to revolutionize processes like cross-border payments, trade finance, and identity verification, leading to more efficient and cost-effective operations.

Artificial Intelligence

Artificial intelligence (AI) is transforming the finance industry by enabling tasks like credit scoring, fraud detection, and customer service to be automated. By harnessing the power of AI, financial institutions can improve the accuracy of risk assessments and provide more personalized services to customers.

Conclusion

Technology continues to revolutionize the finance industry, driving efficiency, security, and innovation. With the adoption of automation, enhanced security measures, and data analytics, financial institutions are better equipped to meet the evolving needs of customers and navigate the complexities of the modern financial landscape.