Introduction

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

Technology has completely reshaped the finance industry in recent years, revolutionizing the way we manage our finances. From mobile payment apps to blockchain technology, the possibilities seem endless. In this article, we will explore the top 10 ways technology is transforming the finance industry.

1. Mobile Banking

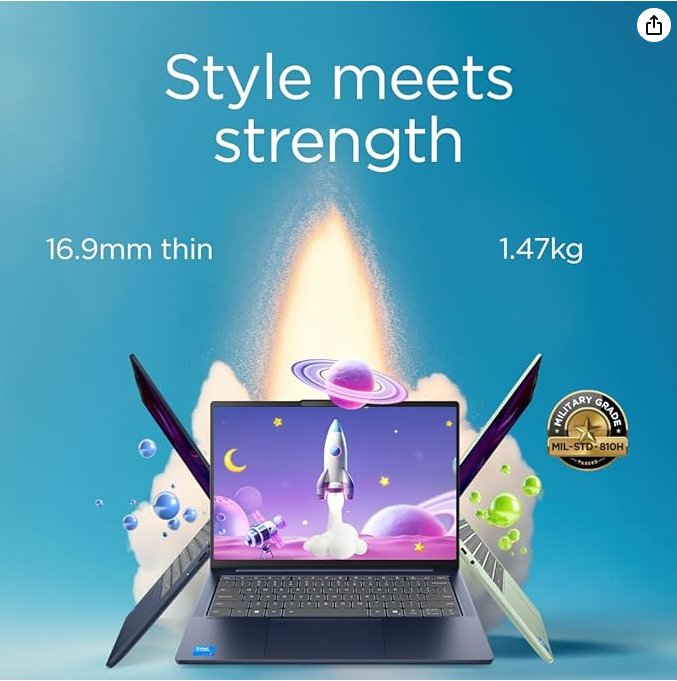

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Gone are the days of waiting in long lines at the bank. With mobile banking apps, customers can now easily check their balances, transfer funds, and even deposit checks with just a few taps on their smartphones. This convenience has revolutionized the way people interact with their finances.

2. Robo-Advisors

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Robo-advisors are automated financial planning services that use algorithms to manage and optimize a client’s investments. These tools provide personalized investment advice at a fraction of the cost of traditional financial advisors, making investing more accessible to the general public.

3. Blockchain Technology

ZTE G5 WiFi 7 5G Router, 3600 Mbps Ultra Fast Home & Office Internet, SIM Slot Unlocked, Dual Band, Connect 128 Devices, 2.5 GbE Port, Smart Antenna – Future Ready WiFi 7

ZTE G5 WiFi 7 5G Router, 3600 Mbps Ultra Fast Home & Office Internet, SIM Slot Unlocked, Dual Band, Connect 128 Devices, 2.5 GbE Port, Smart Antenna – Future Ready WiFi 7

Blockchain technology is revolutionizing the way financial transactions are conducted. This decentralized, secure system eliminates the need for intermediaries, reducing costs and increasing transparency. Blockchain has the potential to completely transform the way we think about currency and financial transactions.

4. Artificial Intelligence

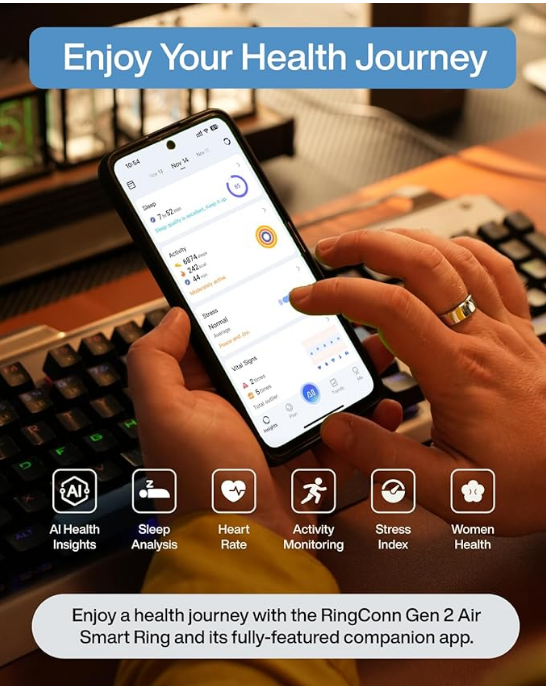

RingConn Gen 2 Air, Ultra-Thin AI Smart Ring, Size First with Sizing Kit, 10-Day Battery Life, Sleep/Heart Rate/Stress/Fitness Tracker, Compatible with Android & iOS - Size 10, Dune Gold

RingConn Gen 2 Air, Ultra-Thin AI Smart Ring, Size First with Sizing Kit, 10-Day Battery Life, Sleep/Heart Rate/Stress/Fitness Tracker, Compatible with Android & iOS - Size 10, Dune Gold

Artificial intelligence is being used in the finance industry to automate processes, detect fraudulent activity, and provide personalized financial advice to customers. AI algorithms can analyze vast amounts of data in real-time, helping financial institutions make informed decisions and improve customer service.

5. Cybersecurity

With the increase in digital transactions, cybersecurity has become a top priority for financial institutions. Advanced technologies such as biometric authentication, encryption, and machine learning algorithms are being used to protect sensitive financial data and prevent cyber attacks.

6. Peer-to-Peer Lending

Peer-to-peer lending platforms use technology to connect borrowers directly with investors, cutting out the middleman and reducing costs for both parties. These platforms offer borrowers lower interest rates and investors higher returns, making the lending process more efficient and transparent.

7. Contactless Payments

Contactless payment methods, such as mobile wallets and wearable devices, are becoming increasingly popular in the finance industry. These secure, convenient payment options allow customers to make purchases quickly and easily, without the need for physical cash or cards.

8. Big Data Analytics

Big data analytics is being used by financial institutions to analyze customer behavior, streamline operations, and identify market trends. This valuable information helps companies make data-driven decisions, improve their products and services, and better meet the needs of their customers.

9. Cloud Computing

Cloud computing has transformed the way financial institutions store and access data. This scalable, secure technology allows companies to store large amounts of data on remote servers, reducing costs and improving flexibility. Cloud computing also enables real-time collaboration and data sharing among employees.

Conclusion

Technology is revolutionizing the finance industry in countless ways, from mobile banking and blockchain technology to artificial intelligence and cybersecurity. As these innovations continue to evolve, we can expect to see even more changes in the way we manage our finances. Embracing these technological advancements can help financial institutions stay competitive and provide better services to their customers.