Are you looking to improve your financial health and start building a solid foundation for your future? Here are five tips that you can implement today to get started.

1. Create a Budget

It Feels Like My Muscles Are Waking Up and Working

It Feels Like My Muscles Are Waking Up and Working

One of the first steps to improving your financial health is creating a budget. By tracking your income and expenses, you can get a better understanding of where your money is going and make adjustments as needed. There are plenty of budgeting tools and apps available to help you stay organized and on track.

2. Cut Unnecessary Expenses

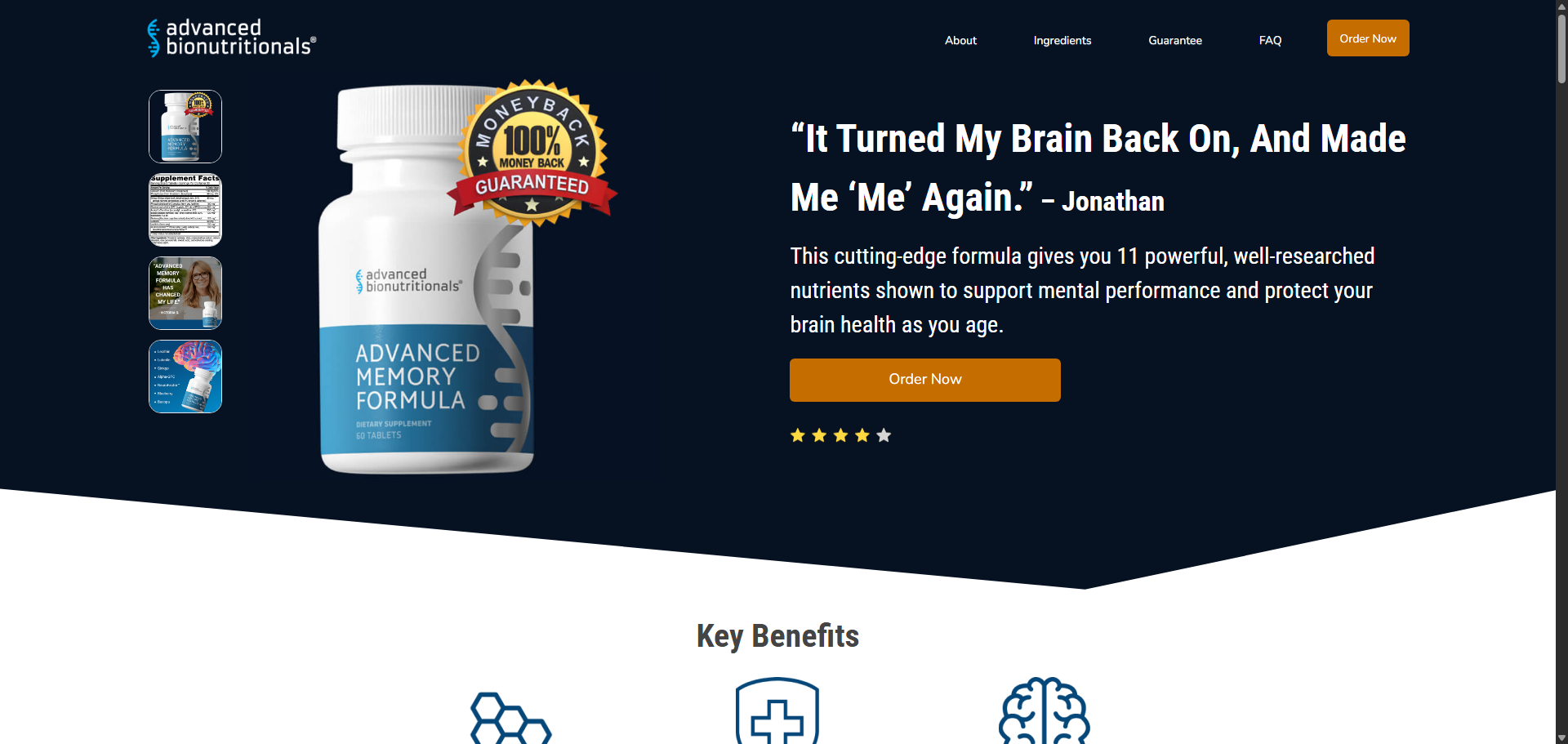

It Turned My Brain Back On, And Made Me ‘Me’ Again.

It Turned My Brain Back On, And Made Me ‘Me’ Again.

Take a close look at your monthly expenses and identify any unnecessary spending. This could be eating out too often, subscribing to services you don’t use, or shopping for things you don’t need. By cutting back on these expenses, you can free up more money to put towards savings or debt repayment.

3. Build an Emergency Fund

This is Like Rocket Fuel for Your Mitochondria!

This is Like Rocket Fuel for Your Mitochondria!

Having an emergency fund is crucial to financial stability. Aim to save at least three to six months’ worth of expenses in a separate savings account. This fund will provide a safety net in case of unexpected events, such as medical emergencies or job loss.

4. Pay Off Debt

High-interest debt can weigh you down and hinder your financial progress. Make a plan to pay off your debts as quickly as possible, starting with the ones with the highest interest rates. Consider consolidating your debts or negotiating with creditors to lower interest rates.

5. Invest in Your Future

Consider investing in retirement accounts, such as a 401(k) or IRA, to secure your financial future. Start contributing to these accounts as early as possible to take advantage of compound interest and maximize your savings over time. Consult with a financial advisor to explore other investment opportunities that align with your goals.

Conclusion

Improving your financial health doesn’t happen overnight, but by implementing these tips, you can take the first steps towards a more secure future. Remember to create a budget, cut back on unnecessary expenses, build an emergency fund, pay off debt, and invest in your future. With dedication and discipline, you can achieve your financial goals and enjoy peace of mind knowing that you are on the right track.