Are you looking to improve your financial fitness and build a healthier bank account? Managing your money effectively is crucial for achieving your financial goals and securing your future. Here are some tips to help you get started on the path to financial wellness.

Set Clear Financial Goals

It Feels Like My Muscles Are Waking Up and Working

It Feels Like My Muscles Are Waking Up and Working

Start by setting specific and achievable financial goals. Whether you want to save for a down payment on a house, pay off debt, or build an emergency fund, having clear objectives will help you stay motivated and focused on your financial journey.

Create a Budget

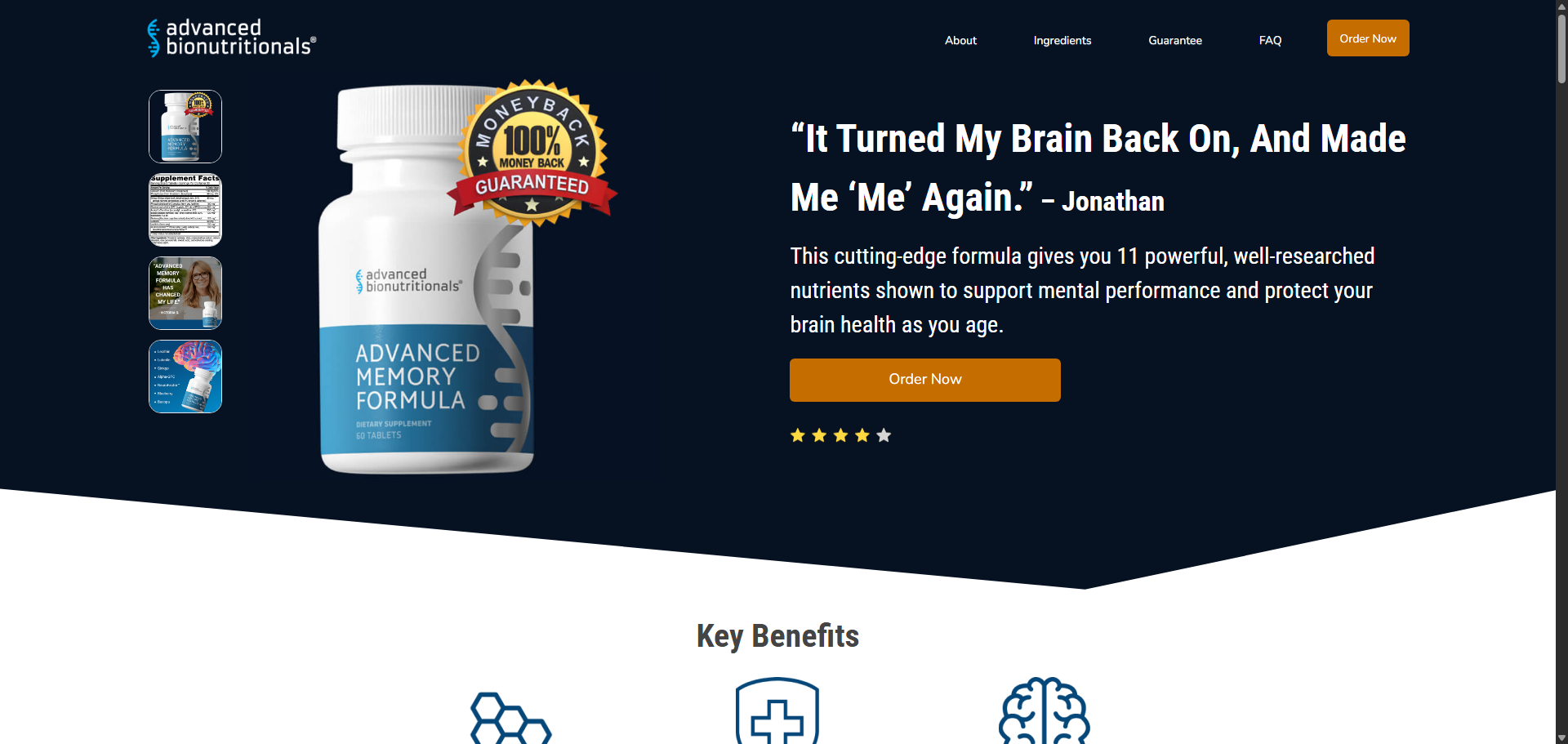

It Turned My Brain Back On, And Made Me ‘Me’ Again.

It Turned My Brain Back On, And Made Me ‘Me’ Again.

A budget is a powerful tool for managing your money effectively. Track your income and expenses to see where your money is going each month. Look for areas where you can cut back on spending and allocate more money towards your financial goals.

Save Consistently

This is Like Rocket Fuel for Your Mitochondria!

This is Like Rocket Fuel for Your Mitochondria!

Make saving a priority by setting up automatic transfers to your savings account each month. Start with a small amount and gradually increase it as you become more comfortable with saving. Building a financial cushion will help you weather unexpected expenses and achieve your long-term goals.

Reduce Debt

High-interest debt can drain your finances and hinder your ability to save and invest for the future. Create a plan to pay off your debts, starting with the ones with the highest interest rates. Consider consolidating your debts or negotiating with creditors to make repayment more manageable.

Invest for the Future

Investing is a key component of building wealth and achieving financial security. Consider opening a retirement account or investing in stocks, bonds, or real estate to grow your money over time. Seek advice from a financial advisor to help you develop an investment strategy that aligns with your goals and risk tolerance.

Review and Adjust Your Plan Regularly

Financial fitness is an ongoing process that requires regular review and adjustment. Monitor your progress towards your goals and make changes to your plan as needed. Stay informed about economic trends and financial developments that may impact your finances.

Conclusion

By following these tips, you can improve your financial fitness and build a healthier bank account. Remember that financial wellness is a journey that requires commitment and discipline. Take control of your finances today to secure a brighter future for yourself and your loved ones.