Welcome to our Ultimate Guide to Boosting Your Financial Health! In this comprehensive article, we will cover everything you need to know to improve your financial well-being and achieve your money goals.

Setting Financial Goals

It Feels Like My Muscles Are Waking Up and Working

It Feels Like My Muscles Are Waking Up and Working

The first step to boosting your financial health is to determine your goals. Whether you want to save for a house, pay off debt, or build your retirement fund, having clear objectives will help guide your financial decisions.

Creating a Budget

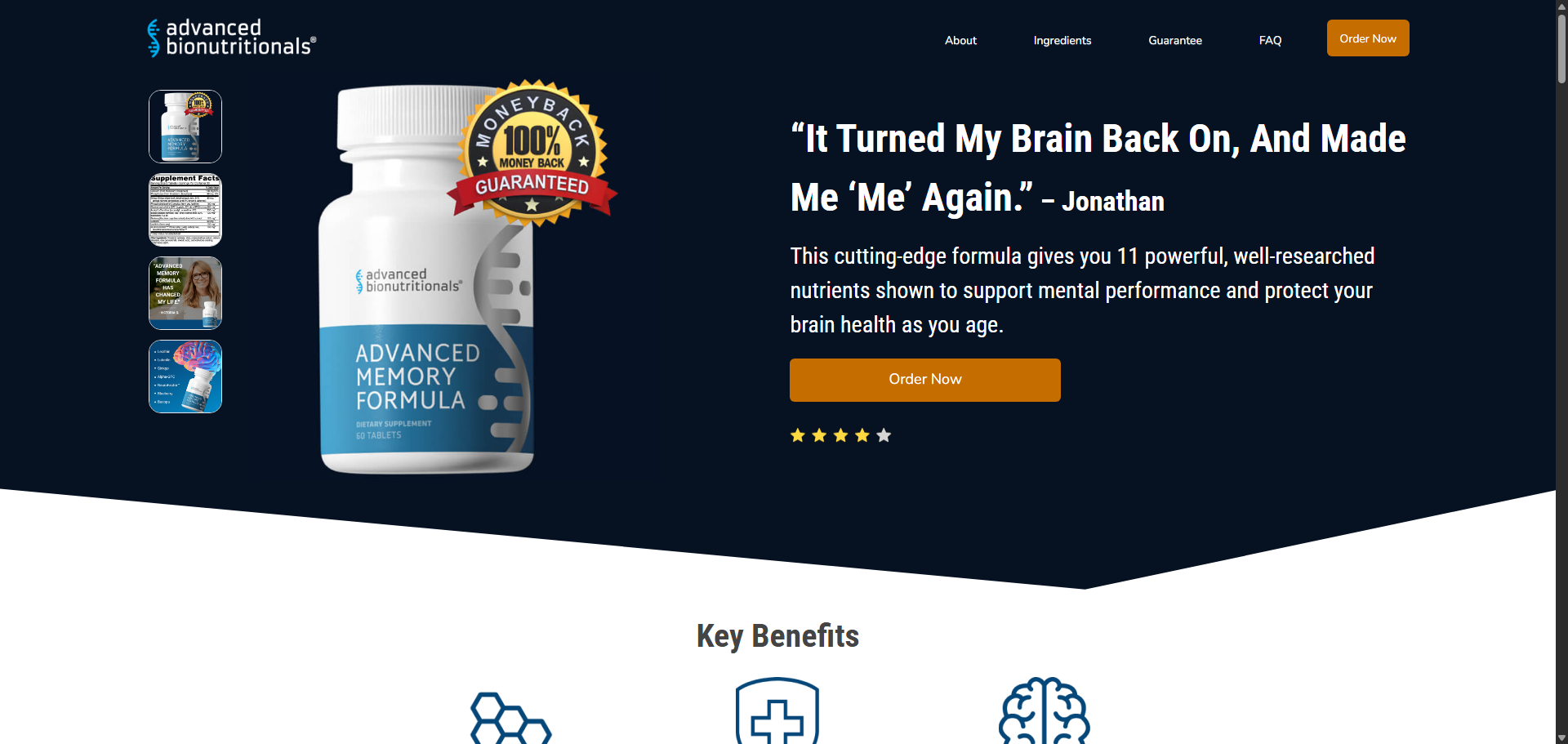

It Turned My Brain Back On, And Made Me ‘Me’ Again.

It Turned My Brain Back On, And Made Me ‘Me’ Again.

One of the most important tools for improving your financial health is a budget. By tracking your income and expenses, you can identify areas where you can cut back and save more money.

Tracking Your Spending

It’s crucial to know where your money is going. By keeping a close eye on your spending habits, you can make adjustments to ensure you are living within your means.

Building an Emergency Fund

This is Like Rocket Fuel for Your Mitochondria!

This is Like Rocket Fuel for Your Mitochondria!

Life is full of unexpected expenses, such as car repairs or medical bills. Having an emergency fund in place can provide you with a financial safety net and peace of mind.

Investing for the Future

Building wealth requires more than just saving money. By investing in stocks, bonds, or real estate, you can grow your money over time and reach your long-term financial goals.

Retirement Planning

It’s never too early to start saving for retirement. By contributing to a 401(k) or IRA, you can ensure a comfortable future for yourself and your loved ones.

Reducing Debt

High-interest debt can hinder your financial progress. By prioritizing debt repayment and exploring consolidation options, you can free yourself from the burden of debt and improve your credit score.

Seeking Professional Help

If you are feeling overwhelmed by your financial situation, don’t be afraid to seek help from a financial advisor. They can provide personalized guidance and strategies to help you achieve your financial goals.

Conclusion

Improving your financial health is a journey that requires dedication and discipline. By setting goals, creating a budget, building an emergency fund, investing wisely, reducing debt, and seeking professional help when needed, you can take control of your finances and secure a brighter financial future.