The financial industry is constantly evolving, and one of the biggest changes in recent years has been the rise of artificial intelligence (AI). Technology is revolutionizing the way we handle money, investments, and financial transactions. Let’s take a closer look at how AI is transforming the financial industry.

The Role of AI in Finance

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

Advanced Health Smartwatch for Women Men with Real-Time Monitoring of Heart rate

Artificial intelligence is being used in a variety of ways in the financial sector. From fraud detection to customer service, AI systems are helping to streamline operations and improve efficiency. Machine learning algorithms can analyze vast amounts of data and make predictions about market trends or customer behavior. This can help financial institutions make better decisions and provide more personalized services to their clients.

Robo-Advisors and Investment Management

One of the most popular uses of AI in finance is in the form of robo-advisors. These automated investment platforms use algorithms to create and manage investment portfolios for clients. Robo-advisors can offer low-cost investment options and personalized advice based on an individual’s financial goals and risk tolerance. This technology is making investing more accessible to a wider range of people.

Automated Trading and Market Analysis

AI is also being used in the financial industry for automated trading and market analysis. Machine learning algorithms can analyze market data in real-time and make trades based on predefined criteria. This can help investors take advantage of opportunities and avoid potential risks in the market. AI tools can also provide insights into market trends and help investors make better-informed decisions.

Customer Service and Personalization

AI is also improving customer service in the financial industry. Chatbots powered by AI can provide instant support to clients, answering common questions and providing assistance with transactions. Machine learning algorithms can also analyze customer data to offer personalized recommendations and services. This level of personalization can help financial institutions build stronger relationships with their clients.

Risk Management and Fraud Detection

Another important use of AI in finance is in risk management and fraud detection. Machine learning algorithms can analyze transactions and identify suspicious behavior in real-time. This can help financial institutions prevent fraud and protect their clients’ assets. AI systems can also analyze market data to identify potential risks and help institutions make better decisions about investments.

The Future of AI in Finance

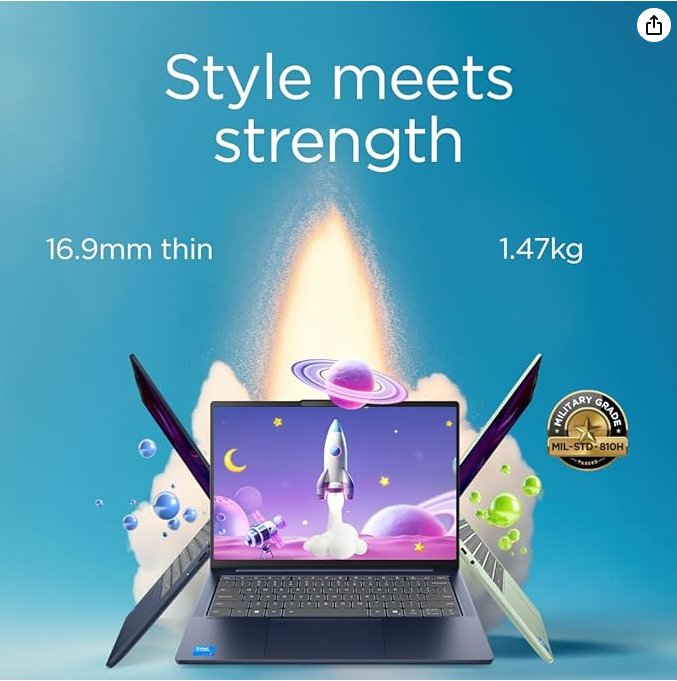

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

As technology continues to advance, we can expect to see even more uses of AI in the financial industry. From automated wealth management to advanced risk analysis, AI is changing the way we think about money and investments. Financial institutions that embrace these new technologies will be better positioned to meet the needs of their clients and stay ahead of the competition.

Conclusion

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

Lenovo IdeaPad Slim 5 | 14 inch WUXGA Laptop | Intel Core i7-13620H | 24 GB RAM | 1 TB SSD | Windows 11 Home | Cosmic Blue

The rise of AI in finance is revolutionizing the industry, making operations more efficient and personalized. From robo-advisors to fraud detection, AI is transforming the way we handle money and investments. As technology continues to advance, we can expect to see even more innovation in the financial sector. It’s an exciting time to be a part of this industry, as AI continues to shape the future of finance.